Returning to the office, hybrid work arrangements, attendance policies, future office space needs and design—these are some areas of focus of CBRE’s Spring 2022 Asia-Pacific, EMEA and U.S. Occupier Sentiment Surveys. The results reflect the views of corporate real estate decision-makers on their evolving approaches to workplaces as offices reopen and the actions they’re taking to accommodate new ways of working. Below are five key takeaways shaping the future of offices worldwide.

01. The return to office is gaining traction

Organizations worldwide anticipate greater office attendance in 2022. More than 75% of respondents expect a more regular return to office during 2022, and over half are trying to influence this outcome today by establishing policies, communicating expectations or having executives and managers lead by example. However, the pace of returning varies widely. Overall, office attendance in the Americas and EMEA remains relatively low, while office attendance in Asia-Pacific, led by Japan, Korea and Taiwan, is essentially back to pre-pandemic levels.

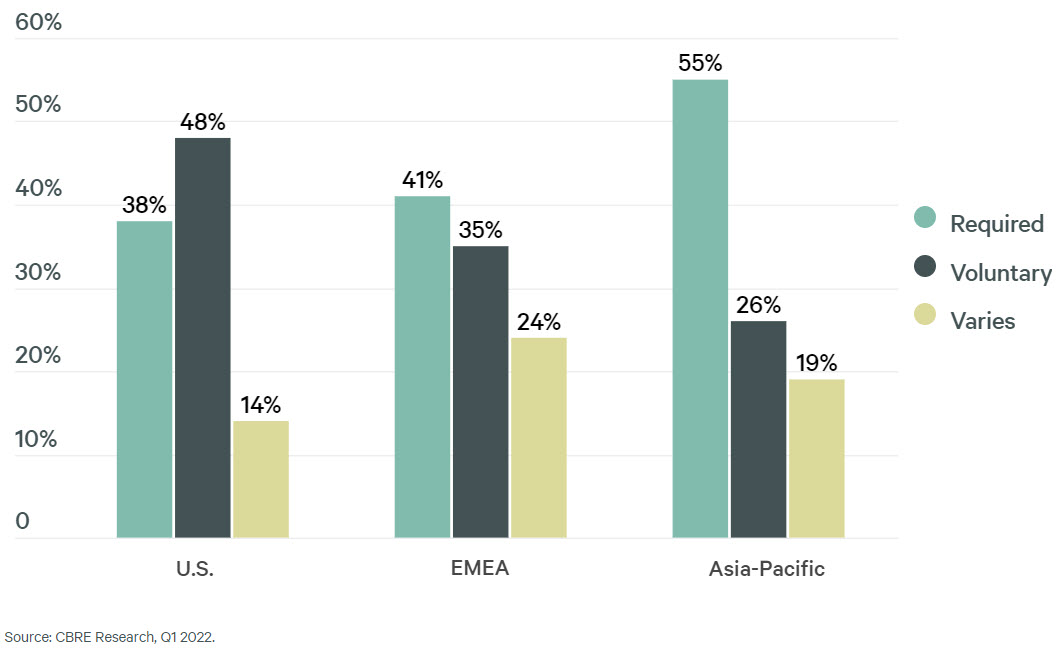

Asia-Pacific was the quickest to return to the office since workers never left in the same numbers as in other parts of the world. Companies in the region were also more likely to require a return than leave the decision up to their employees. However, Australia and India have seen lower office attendance, though occupancy has rebounded in Australia recently.

In the U.S., many companies have taken a voluntary approach, often leaving the decision to return up to their employees and their managers, resulting in lower attendance. The tight U.S. labor environment is a factor, as organizations are sensitive to employee sentiment and work preferences as they seek to retain talent.

Overall, after two years of working from home, companies are taking proactive steps to bring their employees back to the office at a greater scale. Many are establishing clear, consistent attendance policies and timetables across various levels of their organizations. It’s best practice to give individuals and teams time to adjust to new working patterns, enabling them to fine-tune their schedules to plan for dependent care and semi-regular office commutes. Companies that plan thoughtfully—and communicate the purpose and value of the office—will be more successful in achieving buy-in among managers and employees.

Figure 1: Which of the following best describes current guidance for most employees regarding return to office?

02. Hybrid work accepted globally but culturally nuanced

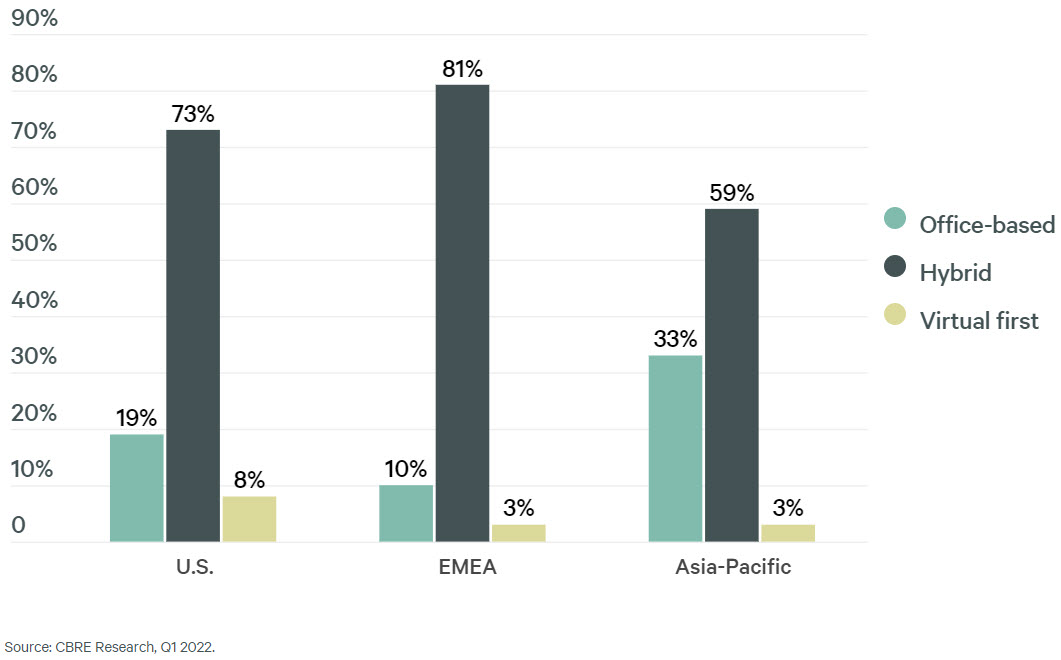

Hybrid work policies are broadly accepted by most companies these days, but adoption differs according to geography and organizational needs. In Europe and the U.S., most employers support hybrid work and are trying to work out policies that allow managers and/or business lines to influence how many (and which) days employees are expected to be in the office. Employees greatly value their autonomy, creating challenges for occupiers seeking to balance employee flexibility while introducing guidance to increase office attendance.

Hybrid work is the preferred strategy among Asia-Pacific companies as well, but to a lesser degree. While more Asia-Pacific organizations intend to embrace hybrid work, few have formulated formal hybrid policies and there is agreement that “test and learn” still has some way to go. A third of Asia-Pacific respondents, led by domestic Asian companies, intend to maintain an office-first workplace policy, the most of any region. Western companies in Asia are more likely to allow hybrid work arrangements with guidelines coming from the managerial level.

By contrast, very few companies across the globe intend to allow employees to work virtually full time, a clear sign that employers still strongly value the physical office.

Figure 2: Workplace policy intentions in a steady state

03. Office presence key to sustaining organizational culture

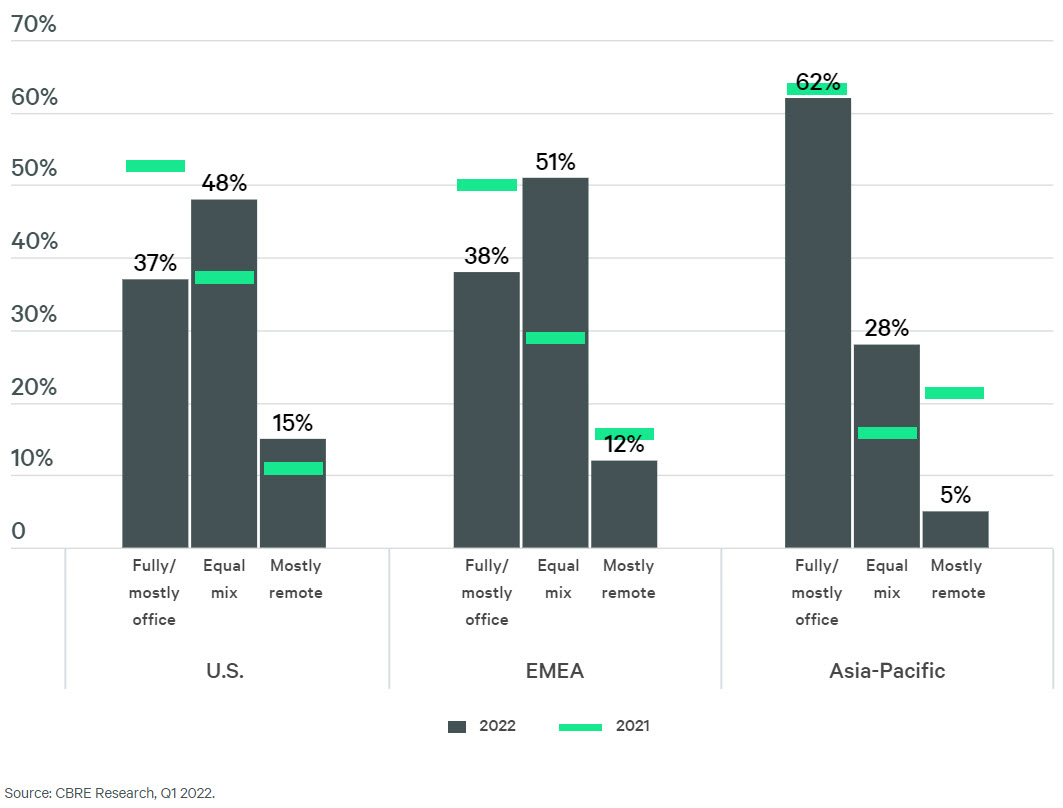

Occupiers still see value in bringing people together in the office and are keen to ensure a vibrant office atmosphere, with most companies expecting employees to spend around half their time in the office. Expectations vary by region, though. In Asia-Pacific, companies expect their staff to spend most of their time in the office, likely resulting in limited impact on office space demand. By contrast, U.S.- and European-based decision-makers have accepted or actively embraced hybrid working arrangements.

The collaborative activities bringing people to the office will influence and change the way offices are designed. These activities create a greater need for shared spaces that suit a variety of activities and less demand for assigned desks for heads-down work that can be done remotely. Occupiers are investing more in interior fit-outs and upgrading to better quality buildings that promote wellness and help attract new and existing talent back to the office.

Figure 3: Looking ahead, which best describes the cultural norm in a steady state that your organization aspires to with workplace policy?

04. Portfolio strategy focusing on quality over quantity

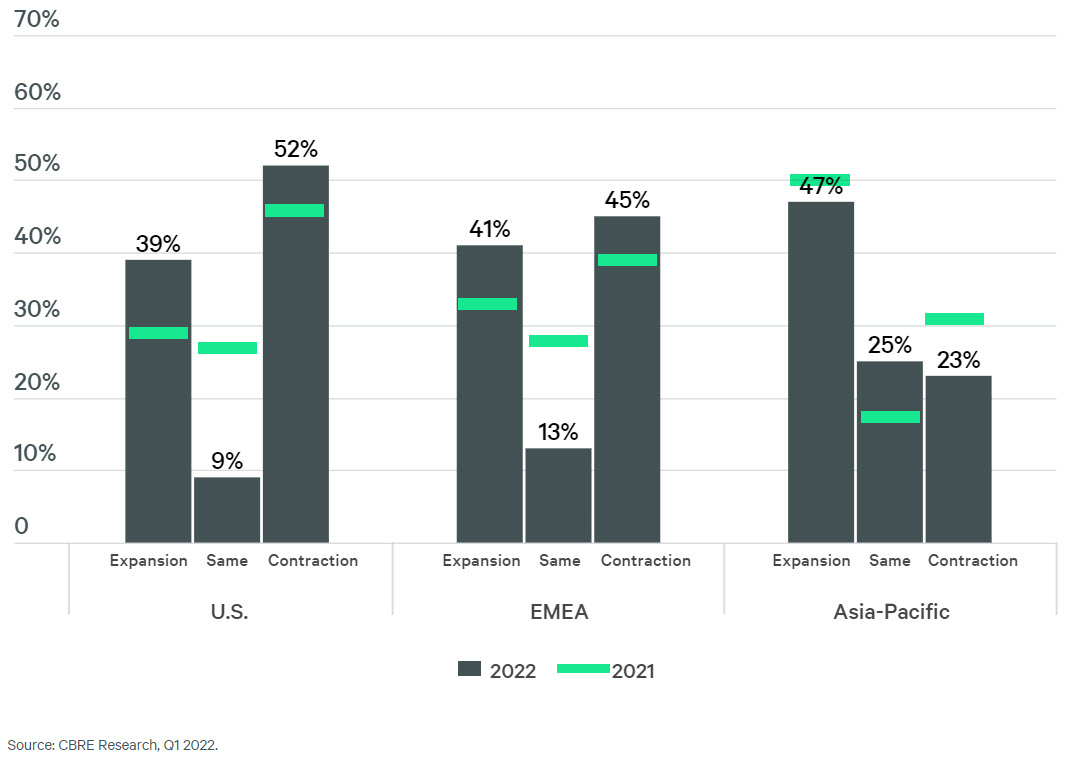

Real estate decision-makers were hesitant to make long-term commitments during the height of the pandemic but are now resuming as their workplace strategies become clearer. In EMEA and the U.S., there was a sharp decline from the responses a year ago in the share of companies that projected their portfolio to stay the same over the next three years. In these regions, very few companies now expect to maintain their current portfolio size, acknowledging that the greater adoption of hybrid work will impact their real estate footprint. Conversely, in Asia-Pacific, the share of respondents that expected to keep their portfolio the same increased while the share that expected it to contract declined sharply from last year.

Real estate professionals in EMEA and the U.S. are divided on their approach. While business growth historically leads to larger office footprints, hybrid work likely requires less space per employee. Globally, about half of respondents expect to expand or maintain the size of their portfolio over the long term. There is a nearly even split in the U.S. and EMEA between companies expecting to expand and those expecting to reduce their portfolios. For those that intend to reduce their footprint, it is largely due to office under-utilization amid hybrid work. Few cite business contraction and expense reductions, as the deciding factor. In Asia-Pacific, where office-based work remains the norm, less than a quarter of respondents expect their portfolios to shrink.

Figure 4: Assuming only organic movement in the portfolio, which of the following best describes your long-term expectations for the total size of your portfolio over the next three years?

05. Preference for better buildings

The purpose of the office is changing as more companies adopt new patterns of working. Building owners are increasingly becoming active partners with their tenants in creating places and experiences that enable workers to be productive, healthy and engaged when at the office.

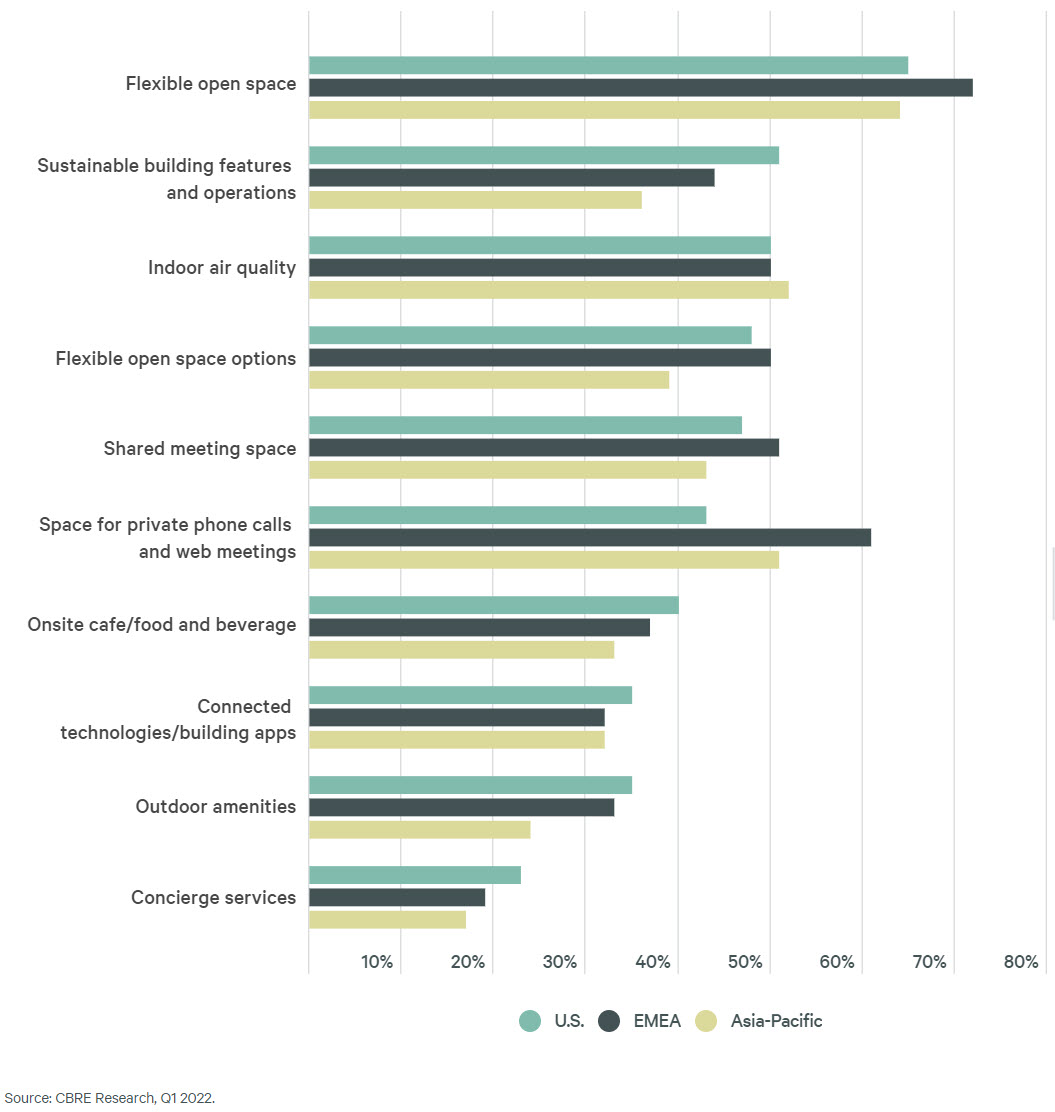

Companies are seeking physical design elements and offerings like highly configurable floorplates (flexible open space), flexible lease terms (flexible office space) and sustainable building features. They’re also looking for space design and offerings that enhance employee wellbeing (indoor air quality) and experience (food & beverage, outdoor space).

Digital offerings are also starting to become more popular, including building apps that help occupiers connect with neighboring tenants, building services and neighborhood amenities.

Figure 5: What will be your most in-demand building offering in the future?